In a recent survey conducted among 5,000 global distributor/dealers, the results unveiled a growing concern about the declining margins in the medtech industry. Key challenges identified included high foreign exchange fees, exposure to changing global currencies, lost purchasing power, and working capital constraints. The highlights of the survey are below along with strategies to break free from the Big Banks.

Survey Highlights

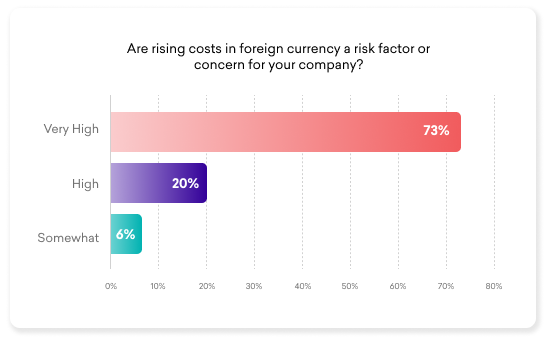

Concerns over Rising Costs and Volatility:

73% of distributors expressed a “very high” concern regarding rising costs and increased volatility in foreign exchange.

Another 20% categorized it as a “high” concern, underlining the severity of the issue.

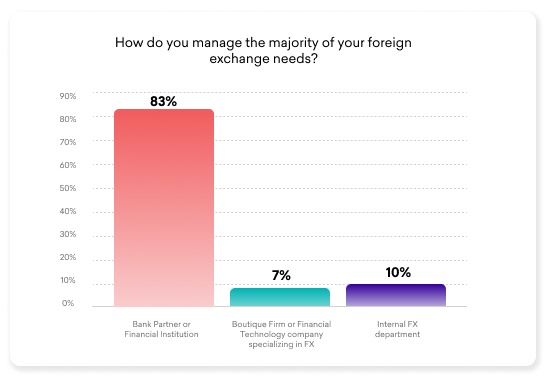

Reluctance to Switch to Alternative FX Providers:

Despite dissatisfaction with excessive fees from banks, only 7% of companies have switched to alternative FX providers. The low percentage of companies transitioning to alternative providers may be due to a lack of awareness of options out there, or a hesitancy to venture beyond the familiar territory of traditional banking.

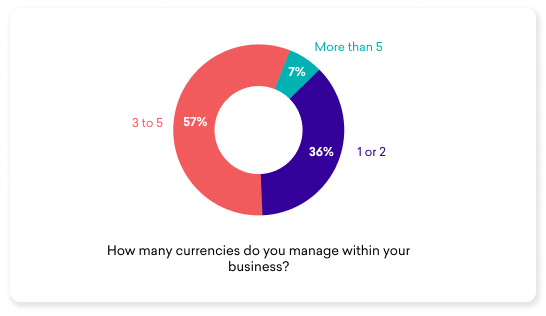

Expansion of Currency Transactions:

Currently, 57% of businesses transact with 3 to 5 currencies.

Remarkably, 86% of respondents indicated plans to add more currencies within the next year, emphasizing the evolving global nature of medtech transactions.

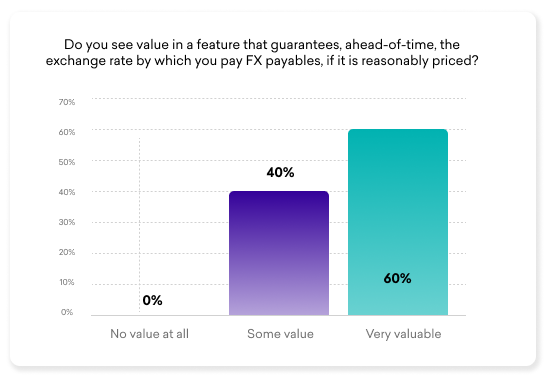

Demand for Future Rate Guarantees:

100% of respondents expressed interest in a feature guaranteeing an exchange rate for a future date with no collateral, provided it is priced reasonably.

This highlights the desire for stability and predictability in managing currency risk.

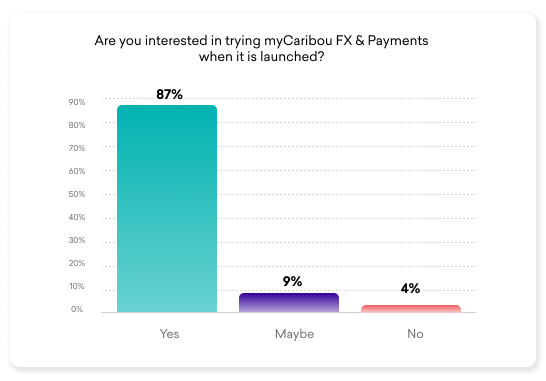

Interest in Medtech-Specific Solutions:

87% of survey participants expressed a preference for a solution that eliminates currency risk, provides working capital, and offers medtech-specific rates.

Addressing the Challenges: myCaribou’s FX & Payments Solution

myCaribou provides a medtech-specific FX solution designed to tackle the challenges identified in the survey:

Cost Savings: Save up to 5% on foreign exchange conversions, including USD, Euros, and 30+ other currencies.

Rate Locks with No Collateral: Enjoy locked FX rates for up to 350 days with no need for collateral or minimums, providing stability in planning and budgeting.

Working Capital Improvement: Improve working capital immediately, addressing the survey’s concern about lost purchasing power and working capital constraints.

Hedging Tools for Currency Volatility: Shield your margins from currency volatility with myCaribou’s hedging tools, ensuring peace of mind in an ever-changing global market.

Medtech-Specific Rates: Responding to the survey’s call for industry-specific solutions, myCaribou offers rates tailored for the unique needs of medtech manufacturers and distributors.

With an innovative approach to global currency exchange, myCaribou FX & Payments is challenging old bank ideologies.

- No monthly fees

- No collateral required

- No minimum transaction limits

Safe, secure and backed by the biggest and best brands in global finance.

Powered by:

myCaribou’s FX & Payments solution is a transformative force in managing global foreign exchange risks for medtech distributors and manufacturers. The survey results emphasize the urgency for a solution like myCaribou, and its innovative features cater directly to the expressed needs of the industry.

Join myCaribou for free to access real-time competitive rates, and safeguard your margins from the uncertainties of currency volatility. Book a meeting to learn more about how myCaribou is reshaping the landscape of medtech currency management.